nh property tax rates by county

Less the first bill amount. Belknap County which runs along the western shores of Lake Winnipesaukee has.

Portsmouth Sets City Property Tax Rate At 15 03 Per 1000 Of Assessed Value

Skip to main content.

. Merrimack County collects on average 193 of a. Rockingham County collects on average 174 of a. Property tax bills in New Hampshire are determined using factors.

A 9 tax is also assessed on motor vehicle rentals. Valuation Municipal County State Ed. The assessed value of the property.

Counties in New Hampshire collect an average of 186 of a propertys. This data is based on a 5-year study of median property tax. Including data such as Valuation Municipal County Rate State and Local Education tax dollar amounts.

New Hampshire has 10 counties with median property taxes ranging from a high of 534400 in Rockingham County to a low of 258200 in. The median property tax in Merrimack County New Hampshire is 4709 per year for a home worth the median value of 243600. Hillsborough County collects on average 179 of a.

The property Tax year runs from April 1st of one year to March 31st of the next year. The median property tax in Hillsborough County New Hampshire is 4839 per year for a home worth the median value of 269900. County Rate State and Local Education tax dollar amounts.

Effective 7119 a new law was passed reducing the interest rate on. The average effective property tax rate in Grafton County is 206 good for fourth-lowest in the state. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

Counties in New Hampshire collect an average of 186 of a propertys. The local tax rate where the property is situated. The median property tax in Cheshire County New Hampshire is 4271 per year for a home worth the median value of 201800.

Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. The tax rate per 1000 of. Tax rate finalized taxes are assessed and property tax bills are mailed.

Interest accrues at the rate of 8 per annum after the due date. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. City of Dover New Hampshire.

THE STATE OF NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION 2020 PROPERTY TAX TABLES BY COUNTY VALUATIONS TAXES AND TAX RATES AS REQUIRED. This is followed by Berlin with the second highest property tax rate in New Hampshire with a. The Strafford County Bar Association has given the City of Dover permission to publish this document on its web site.

To find detailed property tax statistics for any county in New Hampshire click the countys name in the data table above. Cheshire County collects on average 212 of a propertys. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2021 Municipality Date Valuation w Utils.

For example the owner of a home. The median property tax in Rockingham County New Hampshire is 5344 per year for a home worth the median value of 306800. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098.

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. What are the property taxes in Richmond NH. State Summary Tax Assessors.

Evaluate towns by county and compare datasets.

Monadnock Ledger Transcript Towns Set 2019 Property Tax Rates

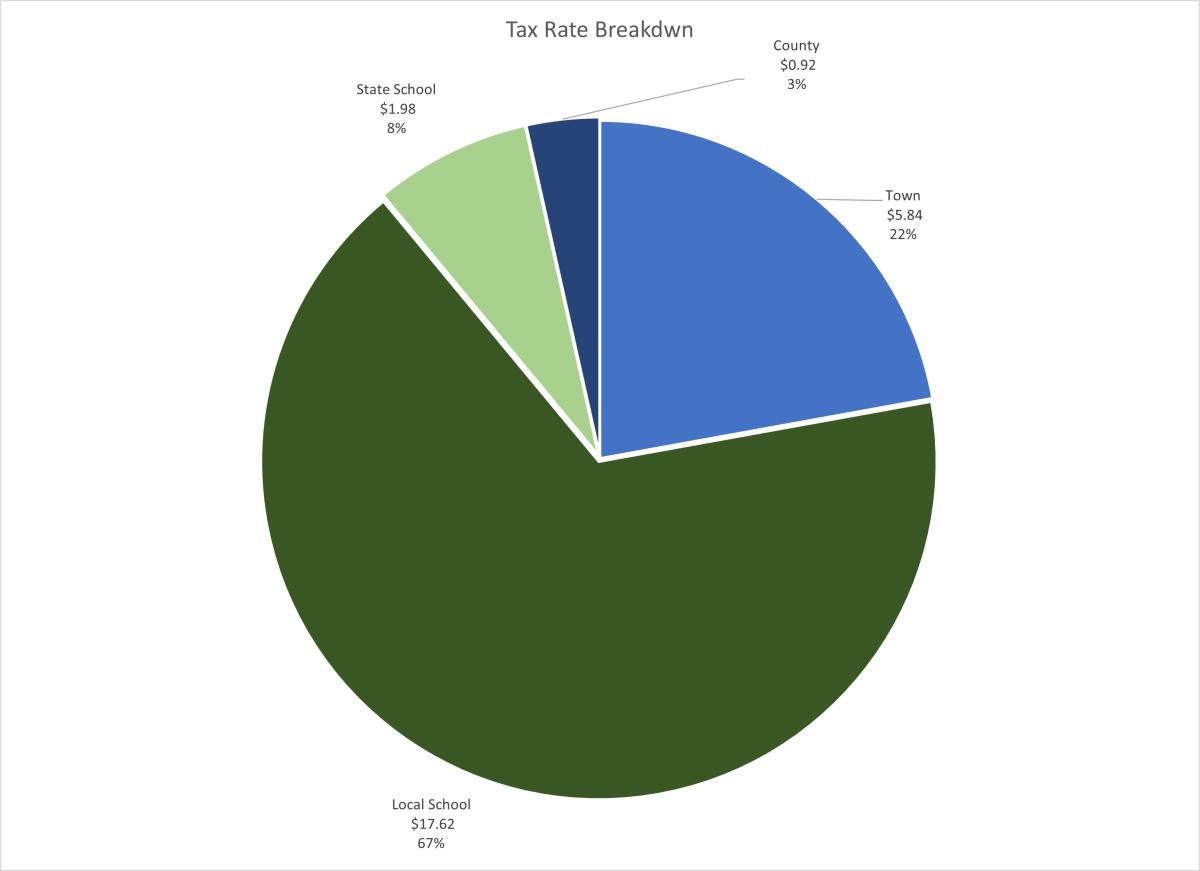

2021 Tax Rate And Explanation Ossipee Nh

Litchfield 2021 Property Tax Rate Set Town Of Litchfield New Hampshire

2021 Tax Rate Press Release The Town Of Seabrook Nh

Exeter 2021 Property Tax Rate Set At 24 01 1 000 Town Of Exeter New Hampshire Official Website

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

Property Tax Information Town Of Exeter New Hampshire Official Website

Sales Taxes In The United States Wikipedia

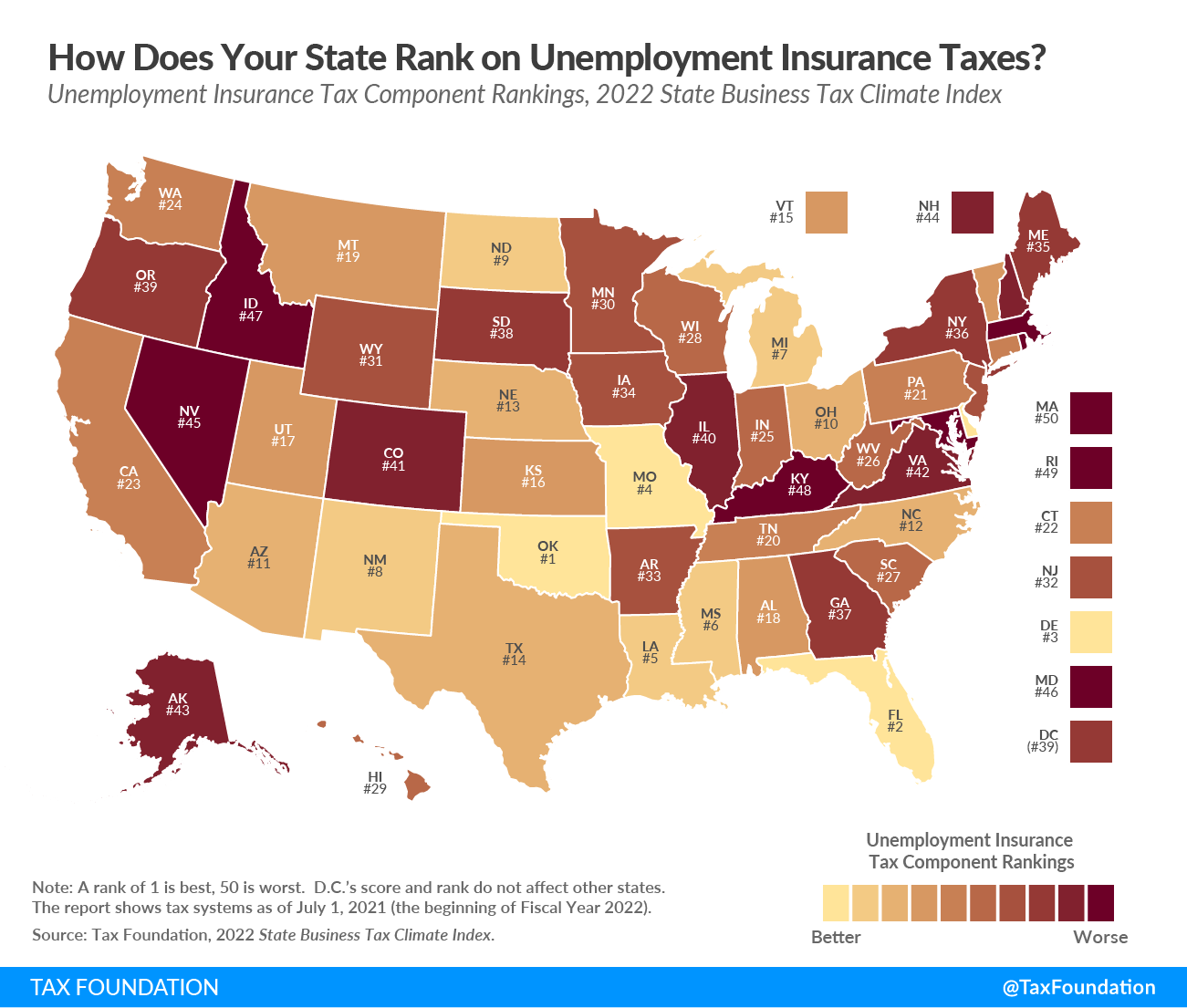

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

Plymouth Residential Property Tax Rates Compared To Other South Shore Towns Plymouth Ma Patch

Which Nh Towns Have Highest Property Taxes Citizens Count

The 2020 Hopkinton Property Tax Town Of Hopkinton Nh Facebook

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Online Maps And Property Record Cards

Town Manager Announces Tax Rate Set At 26 36 Newmarket Nh

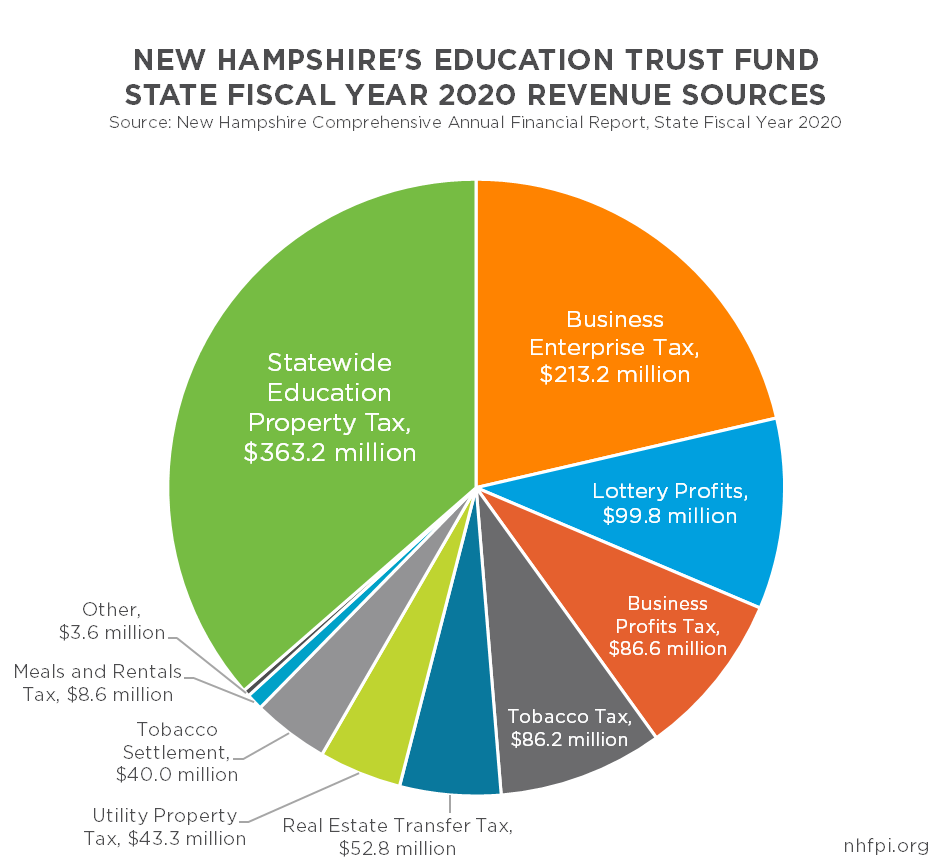

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

Property Tax Assessments Windham Nh

2021 New Hampshire Property Tax Rates Nh Town Property Taxes